Opening an Online Account via NDID 100% Secure and Reliable

You might be wondering how using NDID can replace the traditional process of opening an account at a physical branch.

How can you trust the system? Is it truly secure? Will your personal data be exposed? Could someone impersonate you to perform other transactions? These concerns, along with many other questions, may arise.

Let’s break down and better understand NDID together.

What is NDID?

- 1. NDID is an infrastructure platform providing digital identity verification and authentication services, known as the “NDID Service.” It operates under the supervision of the Electronic Transactions Development Agency (ETDA), a government agency under the Ministry of Digital Economy and Society.

- 2. The NDID system consists of member companies providing digital identity verification and authentication services, known as IdPs (Identity Providers).

Currently, banks serve as the primary Identity Providers, including Bangkok Bank, Krungsri Bank, K Bank, TMB Bank, and Siam Commercial Bank (SCB). - 3. To use NDID services, individuals must first establish a verified Digital Identity (Digital ID) following the criteria below to ensure secure digital identity verification and authentication:

- a. Hold an active and fully operational account with Bank A.

- b. Have previously conducted transactions with Bank A using a national ID card reader at the bank. This ensures that the ID information captured is complete and accurate, adhering to high security standards for online transactions.

- c. Have the Bank A mobile banking application installed, registered, and ready for use.

- d. Have undergone face recognition either through the Bank A mobile application or during an in-branch visit. Facial recognition enhances security and ensures safer online transactions in line with international standards.

- e. Successfully registered for NDID services through the Bank A mobile application.

- 4. Organizations responsible for digital identity verification and authentication (IdP) and financial institutions requesting identity verification services (referred to as Relying Parties: RP) must be registered members of NDID. Membership is subject to strict standards and continuous assessments based on the criteria set by relevant regulatory authorities to ensure the highest level of trust and security for the public using the services.

NDID officially launched its services on February 6, 2020, starting with the “Cross-Bank Online Account Opening” service. This initial service was conducted within a limited scope under the Bank of Thailand (BOT) Regulatory Sandbox, attracting significant interest from users. NDID plans to expand its services to cover other business sectors, including securities companies, asset management firms, insurance companies, and credit information providers.

As of November 9th, 2020, 17 companies from these industries were ready to join the Production Environment under the BOT Regulatory Sandbox, with further plans to expand the scope of services in the future.

Steps for Opening an Online Securities Account

Example: Mr. A, an existing customer of Bank A, meets all the qualifications to use NDID services and wishes to open an online securities account with Securities Company B by choosing to verify his identity through the NDID service.

(In this case, Bank A serves as the Identity Provider (IdP), while Securities Company B acts as the Relying Party (RP))

Step 1: Open an account with the securities company through the company’s website or mobile application

- Mr. A visits the website or downloads the mobile application of the securities company he wishes to open an account with (Securities Company B).

- He selects the option for online securities account opening, fills in the required information, and clicks to accept the terms and conditions of the service.

- He chooses to verify his identity through the NDID service and selects the bank to perform the identity verification (Bank A, which serves as the IdP in this case).Has all the required qualifications to use NDID services as follows:

- a. Holds an account with Bank A.

- b. Has conducted transactions with Bank A, including inserting their national ID card into Bank A’s card reader for verification.

- c. Has Bank A’s mobile banking application installed and registered for use.

- d. Has completed facial recognition verification at a Bank A branch or via Bank A’s mobile application.

- e. Has registered for NDID services through Bank A’s mobile application.

(For Bangkok Bank and K Bank, this can be done by accessing the “NDID Service” menu on their mobile applications.)

Step 2: Verify identity via Bank A’s Mobile Application.

Mr. A will receive a notification from Bank A’s mobile application prompting him to verify his identity.

He should select the NDID service, accept the terms and conditions, and follow the steps provided by the bank, which may include:

- Entering his Username and Password.

- Performing facial recognition.

- Receiving an OTP (One-Time Password) sent to the registered mobile number and entering it into the application.

After completing these steps, a confirmation message indicating successful identity verification will be displayed.

Step 3: Continue the account opening process on the securities company’s website or mobile application.

Mr. A returns to the website or mobile application of Securities Company B to complete the securities account opening process by following the steps specified by the company. He will then wait for Securities Company B to notify him of the approval result for the account opening.

Opening an online securities account using identity verification through NDID is convenient and straightforward, accessible anytime and anywhere, aligning perfectly with the New Normal lifestyle.

With a secure system powered by internationally recognized technology standards, users can have full confidence that no one can impersonate them to perform digital transactions.

Moreover, having the required qualifications to use NDID services allows users to access other services requiring identity verification entirely online.

Additional services will continue to be introduced in the future, further expanding the convenience of digital transactions.

For more information, please visit www.ndid.co.th

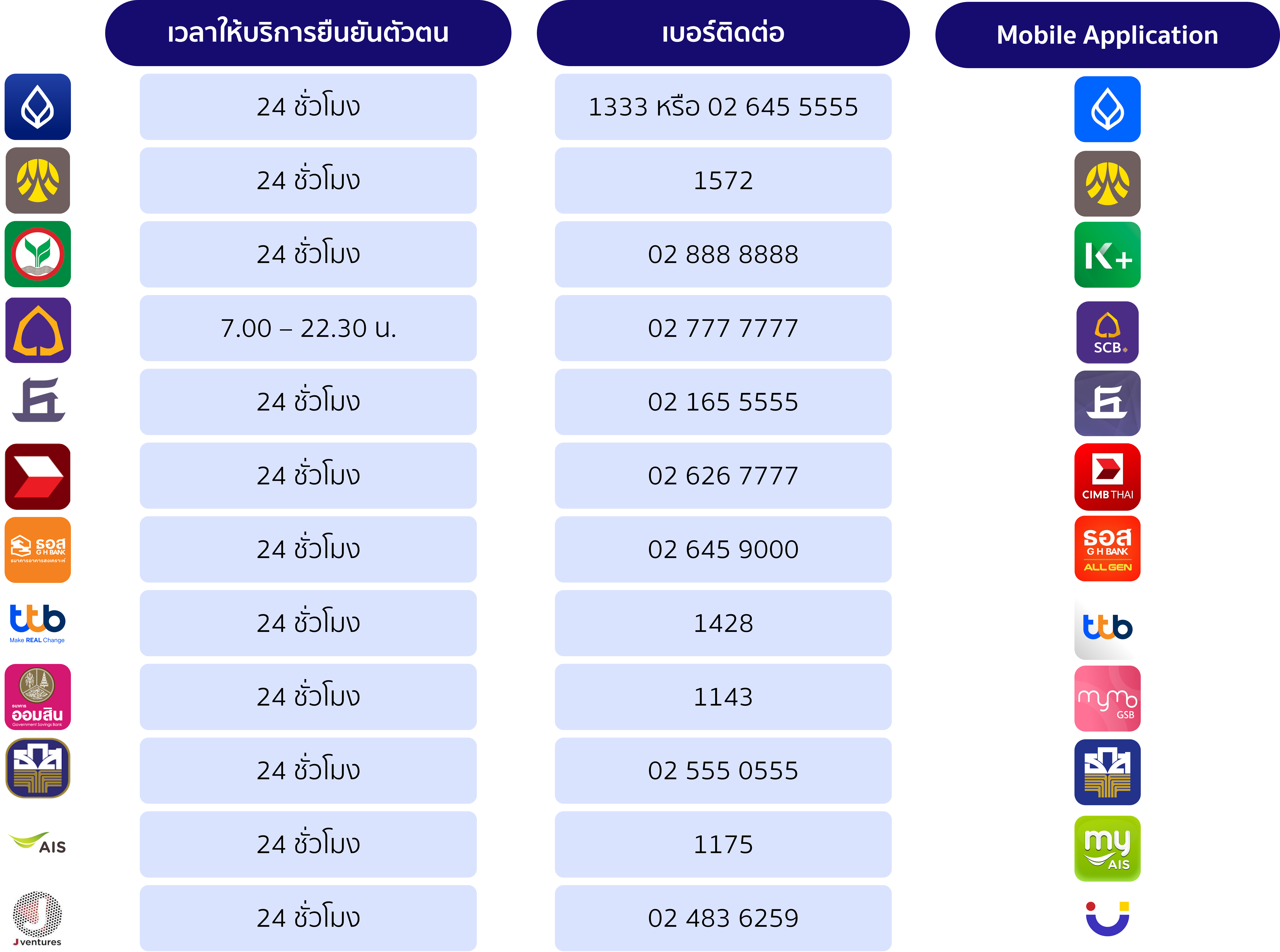

Service Channels, Operating Hours, and Contact Information of Identity Providers (IdP)